This Pension Governance Policy (“Policy”) establishes the governance structure for the Pension Plan for the Employees of First Nations University of Canada Inc., registration no. 0934091 (the “Pension Plan”) and outlines the roles and responsibilities of the various parties involved in the administration and governance of the Pension Plan.

First Nations University of Canada Inc. (the “University”) sponsors the Pension Plan to assist its employees to save for their retirement. As a defined contribution pension plan, there is no guarantee on the level of pension benefits members could receive from the Pension Plan when they retire. The pension benefit for each member will depend on the level of employer and employee contributions, the investment option(s) selected by the member and the performances of these investment options.

The Pension Plan is registered with the Financial and Consumer Affairs Authority of Saskatchewan (the “FCAA”) and subject to the Saskatchewan Pension Benefits Act, 1992 (the “PBA”) and the Income Tax Act (the “ITA”), collectively referred herein as the “Applicable Law”.

As the administrator of the Pension Plan, the University is responsible for the oversight, management and administration of the Pension Plan as well as the assets in the Pension Plan. In its capacity as the Pension Plan administrator, the University seeks to administer the Pension Plan in accordance with the Applicable Law mentioned above as well as consider relevant best practices in the pension industry, as informed by the following guidelines issued by the Canadian Association of Pension Supervisory Authorities (“CAPSA”):

This policy is prepared in accordance with the Pension Plan’s established objectives, Applicable Law and relevant industry best practices as deemed appropriate. The Policy is intended to be consistent with and complementary to the other policies in place with respect to the Pension Plan, including the Terms of Reference for the Management Pension and Benefits Committee, the Terms of Reference for the Pension and Benefits Advisory Committee, the Code of Conduct and Conflict of Interest Policy, as well as the Pension Plan text and any amendments thereto and any collective agreement(s) in place in respect of Pension Plan members. In the event of any inconsistency between this document and the Pension Plan text or an applicable collective agreement, the Pension Plan text or the respective collective agreements shall prevail, to the extent of the inconsistency.

External delegates for the Pension Plan:

The policy states the following:

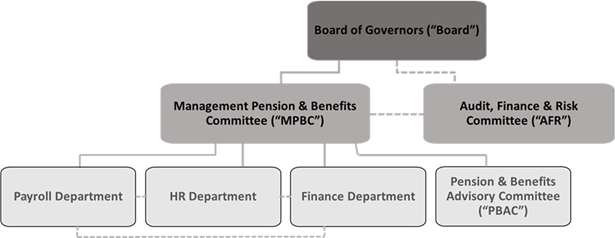

The University, acting through the Board of Governors (the “Board”), is the sponsor of the Pension Plan and has ultimate fiduciary and administrative responsibility for the Pension Plan.

Where there is a reference in the Plan text, this Policy or any other policy in place in respect of the Pension Plan for an action to taken, consented, or approved by the University, these shall be done through the Board or a delegate thereof.

The Board has established the Management Pension and Benefits Committee (the “MPBC”) and delegated it to carry out the main day-to-day responsibility of Pension Plan administration as required by the University in its capacity as the administrator of the Pension Plan.

The Board has also established a Pension and Benefits Advisory Committee (the “PBAC”) to advise on matters related to the Pension Plan as set out in this Policy and in the Terms of Reference for the Pension and Benefits Advisory Committee.

The Board shall:

The Board has designated the Audit, Finance and Risk Committee (the “AFRC”), which is an extension of the Board, to assist with the oversight of the operations, administration and governance of the Pension Plan.

The AFRC may make recommendations to the Board with respect to changes to the Pension Plan design or its governance framework and assist with any other Pension Plan-related responsibilities that fall to the Board.

The Board has designated the MPBC to carry out the Board’s administrative responsibilities with respect to the Pension Plan including its day-to-day operations and to ensure that the activities are carried out in a timely manner and in the best interest of the Pension Plan members as well as its beneficiaries.

The MPBC’s central responsibilities towards the Pension Plan shall include:

The Terms of Reference for the Management Pension and Benefits Committee sets out additional responsibilities of the MPBC.

The Management Pension Committee shall delegate certain day-to-day administrative responsibilities to the University’s Human Resources, Payroll and Finance departments, including tasks related to member enrollment, contribution remittance, plan and member record maintenance, engagement, member education and communication, as well as supporting with the completion of required filings as per Applicable Law.

The respective responsibilities of the departments of Human Resources, Payroll and Finance are set out in greater detail in the Terms of Reference for the Management Pension and Benefits Committee.

The Board has created the PBAC to advise it on matters related to the Pension Plan, make recommendations with respect to the Pension Plan and assist the MPBC in promoting awareness and understanding of the Pension Plan among members.

In order for the PBAC to carry out its duties, it shall be provided updates on the Pension Plan administration and the activities carried out by the MPBC. In fulfilment of its Pension Plan obligations, the PBAC shall prepare and submit to the Board through the MPBC an annual report on the Pension Plan and its activities. The Pension and Benefits Advisory Committee’s responsibilities are further detailed in the Terms of Reference for the Pension and Benefits Advisory Committee.

The Members are individuals with accumulated benefits in the Pension Plan. As participants of the Pension Plan, each member is responsible for understanding Pension Plan and planning for their respective retirement. Members assume the sole responsibility for making investment decisions, monitoring the performance of their investments, and making any changes to their investments based on their respective retirement goals, risk tolerances and investment horizons.

The external pension service provider has been retained by the University to provide custodial, recordkeeping and investment management services for the Pension Plan. The Pension Plan’s assets shall be held in accordance with the terms of the service agreement and Applicable Law. The MPBC may engage the pension service provider for additional services such as member education and communication services or other services in order to meet its responsibilities.

The University may also obtain services from other external services providers to assist it in carrying out certain responsibilities with respect to the Pension Plan or obtain advisory services to carry out its responsibilities in respect of the Pension Plan.

While this Pension Policy focuses on the governance framework related to the Pension Plan, the Terms of Reference for the Management Pension and Benefits Committee, the Terms of Reference for the Pension and Benefits Advisory Committee, and the Code of Conduct and Conflict of Interest Policy, includes consideration on the governance as it relates to the Benefits Plan.